Global inflation for 2025 is marked by significant uncertainty driven by multiple factors. Slowing demand in China is exerting downward pressure on global commodity exports, while structural vulnerabilities in industrial economies make them more susceptible to global supply shocks. Advanced economies, which experienced historic inflation spikes, have largely succeeded in bringing price growth under control and are on track to reach their targets by 2025. Other developing markets, such as Brazil and Mexico, continue to contend with persistent inflation due to strong labor markets and ongoing trade disruptions connected to China and the United States. Meanwhile, countries like China and Thailand, which have more recently grappled with disinflationary trends, are likely to experience moderate price increases in the coming year.

Sensitivity to tariffs further differentiates inflationary pressures across economies. Industrial and export-driven economies, such as Germany and Mexico, are particularly vulnerable to tariff adjustments due to their reliance on integrated global supply chains. For instance, increased tariffs on key inputs can quickly raise production costs, which may pass through to consumer prices. Conversely, service-based economies, like the UK, are less directly exposed to tariff-driven inflation but may still feel indirect effects through imported goods and materials. Commodity-exporting countries, such as Brazil or Indonesia, are also sensitive to tariffs on raw materials, which can alter global demand for their exports and influence currency values, further affecting inflation trajectories. And finally, diversified economies like the U.S. may see higher import inflation, but have more room to offset costs in other domestic industries compared to other countries with a single dominating sector.

Below, we provide our inflation forecasts through 2025 across different countries and compare them with the most reliable public benchmark currently available, drawing from sources such as central banks, surveys of professional forecasters, and other well-regarded institutions. To better understand the trajectory of inflation across regions, it is useful to categorize economies based on their key economic drivers—service-oriented, industrial, commodity-driven, and diversified—and consider how these dependencies shape their inflation dynamics. Given these categorizations, we provide key indicators we’re watching as inflation trajectories evolve through 2025.

Expected YoY Inflation for Commodity-Driven Economies

Countries reliant on commodities—such as Brazil, South Africa, Indonesia, and Norway—are highly sensitive to global demand and currency fluctuations. Slowing Chinese demand has weakened exports, putting pressure on currencies and increasing import costs, amplifying inflation. In oil-reliant economies like Norway, lower export revenues challenge disinflation efforts. Tight labor markets further reinforce inflationary pressures through sustained consumption and wage growth.

Key Indicators to Watch:

· Commodity demand and prices: Benchmark indices (Brent Crude Oil)

· Currency valuations: Exchange rate trends (Brazilian Real, South African Rand) relative to USD

· Labor Market Pressures: Wage growth in commodity-linked sectors (mining, agriculture)

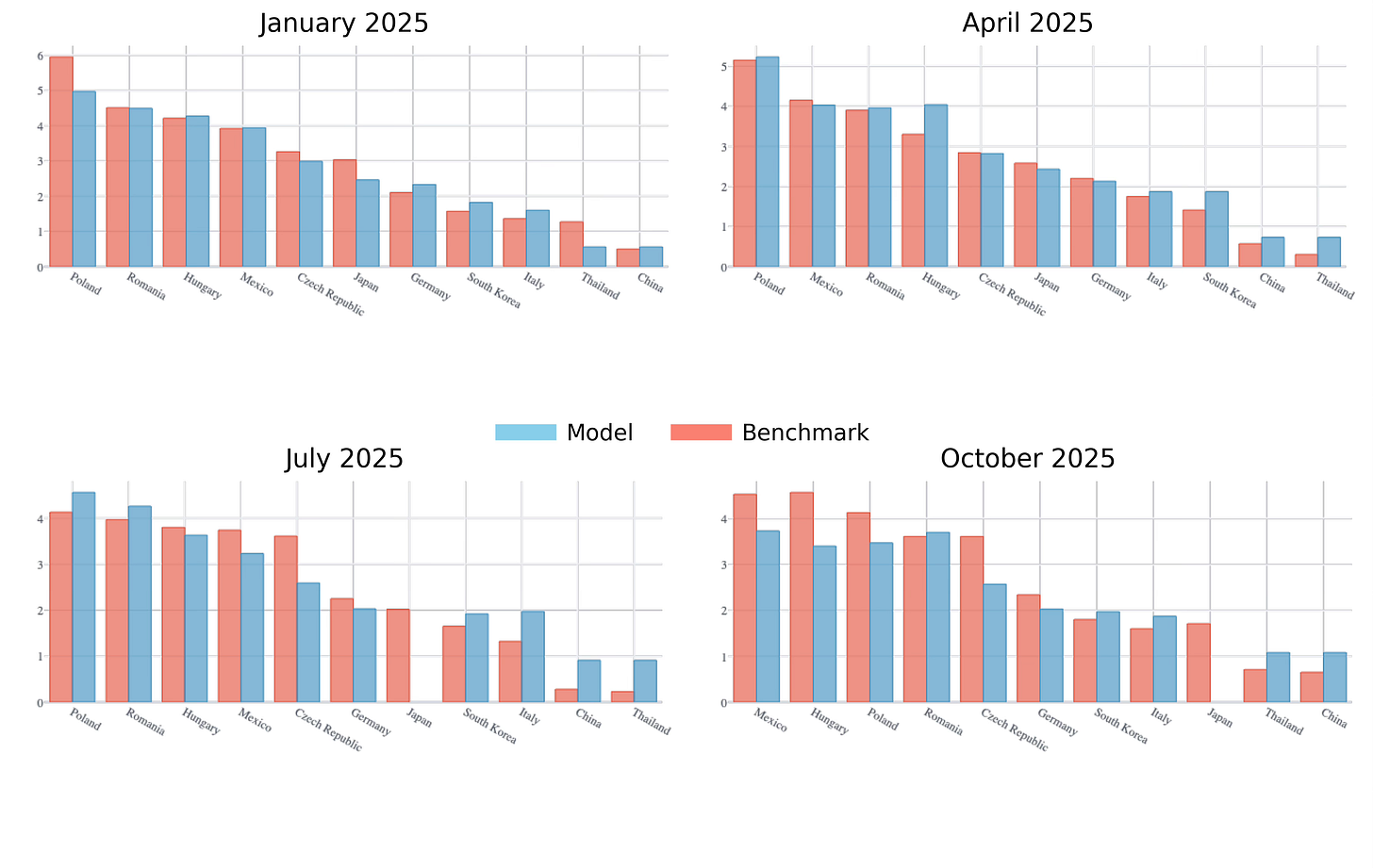

Expected YoY Inflation for Industrial Economies

Industrial economies such as Germany and Poland remain vulnerable to supply chain disruptions, trade tensions, and resource constraints, which drive up production costs. Structural challenges and moderating wage growth suggest inflation reductions will be gradual. In contrast, economies like Thailand and China, which have recently experienced disinflation, may see inflation rise slightly as demand normalizes.

Key Indicators to Watch:

· Global Supply Chain Metrics: Baltic Dry Index (shipping costs)

· Trade Relations and Policies: Tariff changes and sanctions affecting key industries (U.S. tariffs against China and other trading partners)

· Wage and Productivity Trends: Unit labor costs in manufacturing sectors

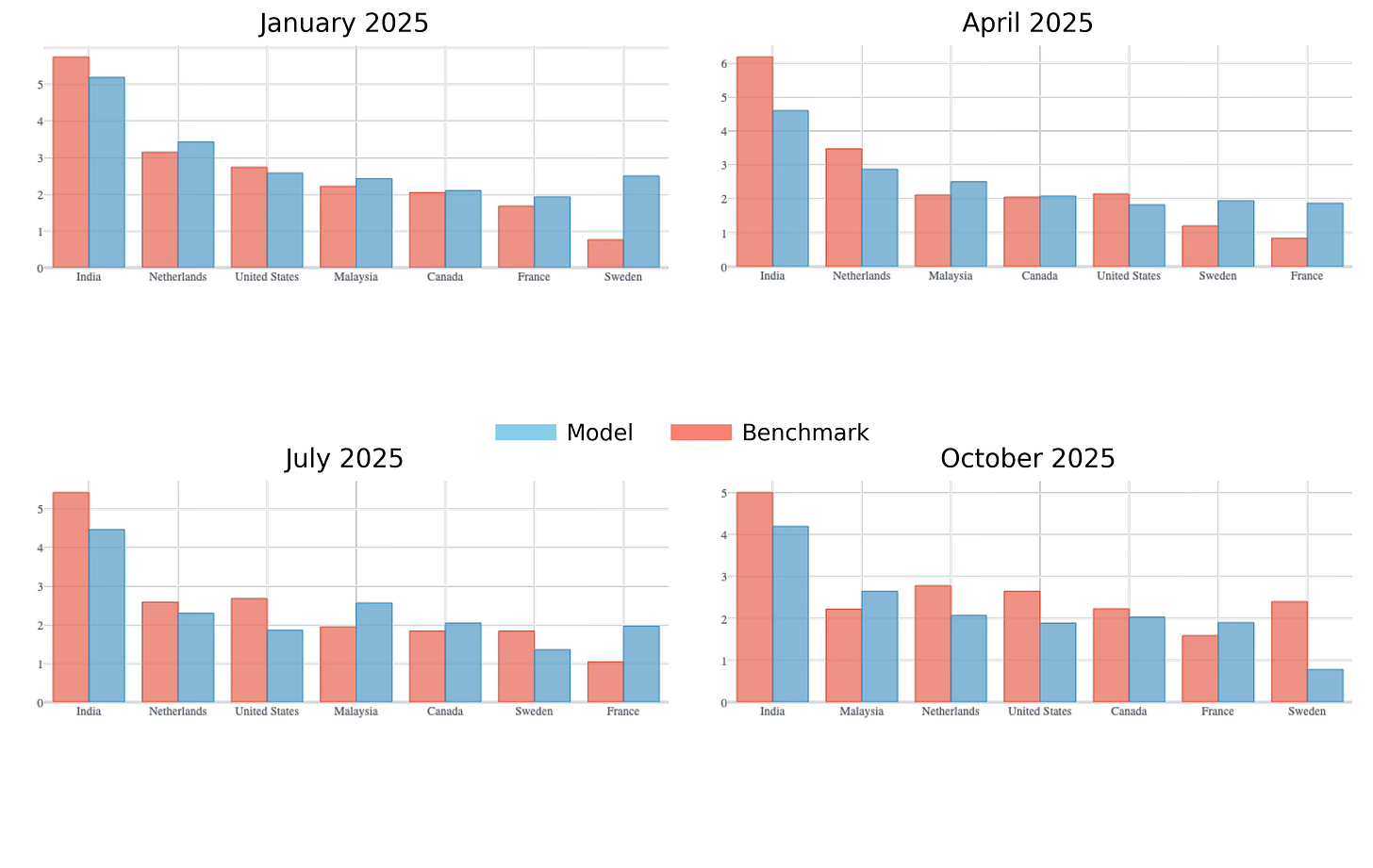

Expected YoY Inflation for Diversified Economies

In economies like the United States, France, and India, inflation trends are shaped by a mix of factors, from food prices (India) to services and wages (U.S., France). Advanced economies are on track to stabilize inflation near central bank targets, supported by institutional strength and policy flexibility. In India, inflation remains higher, driven by food prices and vulnerabilities in supply chains.

Key Indicators to Watch:

· Service-Sector Inflation: Job openings and quits rate in high-demand service sectors

· Food Inflation: Rainfall data during monsoon seasons and agricultural output (India)

· Manufacturing Trends: input costs in manufacturing sectors

Expected YoY Inflation for Service Economies

In service-heavy economies like the UK and Spain, the inflation trajectory is influenced primarily by labor market dynamics, persistent cost pressures in key service sectors, and evolving productivity trends. Following inflationary pressures in recent years—driven by supply chain disruptions and surging post-pandemic demand—both economies are gradually stabilizing. Inflation rates are expected to converge toward central bank targets by 2025.

Key Indicators to Watch:

· Service-Sector Inflation: Job openings and quits rate in high-demand service sectors

· Consumer Demand Trends: Tourism recovery indices and international arrivals (Spain)

· Central Bank Inflation Guidance: Inflation expectations surveys for businesses and consumers

As the year progresses, Turnleaf will closely monitor the key indicators aligned with each country’s economic structure to refine our inflation forecasts. Updates on policy developments, such as tax adjustments, price control measures, and changes in trade policies, including the imposition or removal of tariffs, will be integrated into our analysis. By considering how these factors influence global supply chains, production costs, and consumer prices, we aim to provide projections that remain reflective of economic conditions.